Binance is the world’s largest cryptocurrency exchange, and it offers a lot of options for those looking to short on Bitcoin and other cryptocurrencies. Here’s a general guide on how to do it.

What is Binance and how does it work?

Binance is a cryptocurrency exchange that allows you to trade digital assets including cryptocurrencies. It is one of the most popular exchanges in the world with a wide range of features and a user-friendly interface. You can buy and sell cryptocurrencies on Binance, as well as use it to store your digital assets.

Binance is a centralized exchange, which means that it is not decentralized like some other exchanges. This means that it is subject to government regulation and can be shut down by the government if it violates any laws. Binance is registered in Malta and has a office in Hong Kong.

You can also try day trading crypto on FTX and check out Ethereum 2.0 price prediction so you can watch out of price surges!

The 7 different ways you can short on Binance

1) Shorting with a market order

This is the most straightforward way to short on Binance. You simply place a sell order for an asset at the market price. The order will then be executed at the best available price and you will have sold the asset short.

2) Shorting with a limit order

With a limit order, you can set the price at which you want to sell the asset. The order will only be executed if the asset reaches that price, at which point you will have sold it short.

3) Shorting with a stop-limit order

A stop-limit order is similar to a limit order, but with an additional “stop” price. The order will only be executed if the asset reaches the stop price, at which point it will become a limit order and will be executed at the specified limit price. This type of order can be used to protect against sudden losses in the value of an asset.

4) Shorting with a margin order

Margin orders allow you to borrow money from Binance in order to trade with leverage. When you short with a margin order, you are essentially borrowing money from Binance in order to sell the asset. The amount of leverage you can use will depend on the asset being traded and the size of your account.

5) Shorting with a futures contract

Futures contracts are agreements to buy or sell an asset at a future date for a specified price. When you short a futures contract, you are agreeing to sell the asset at the specified price on a future date. If the price of the asset falls below the specified price before the future date, then you will make a profit on the trade. If the price of the asset rises above the specified price, then you will incur a loss.

6) Shorting with options

Options are contracts that give the holder the right, but not the obligation, to buy or sell an asset at a specified price on or before a certain date. When you buy an option, you are effectively buying insurance against a fall in the price of an asset. If you think the price of an asset is going to fall, then you can buy a put option, which gives you the right to sell the asset at a specified price on or before a certain date. If the price of the asset does indeed fall, then you can exercise your option and sell it for more than it is worth on the open market, making a profit. If the price of the asset rises, then your option will expire worthlessly and you will lose your initial investment.

7) Shorting with CFDs

CFDs are contracts for difference, which are derivative products that allow you to speculate on changes in an underlying asset’s price without actually owning that asset.

Why you should start shorting on Binance

There are different ways to short on Binance, including margin trading and using futures contracts. Here are some reasons why you should start shorting on Binance and how you can make the most out of it:

1) Shorting allows you to profit from a falling market.

2) It enables you to hedge your positions and protect your downside.

3) Shorting is a way to express your bearish market view.

4) You can short individual stocks, ETFs, and even cryptocurrencies.

5) Binance is one of the most popular exchanges for shorting.

Shorting can be a risky strategy, so be sure to use stop-loss orders and take proper risk management measures. To be more inspired in shorting, here’s list of top Netflix movies about finance to watch.

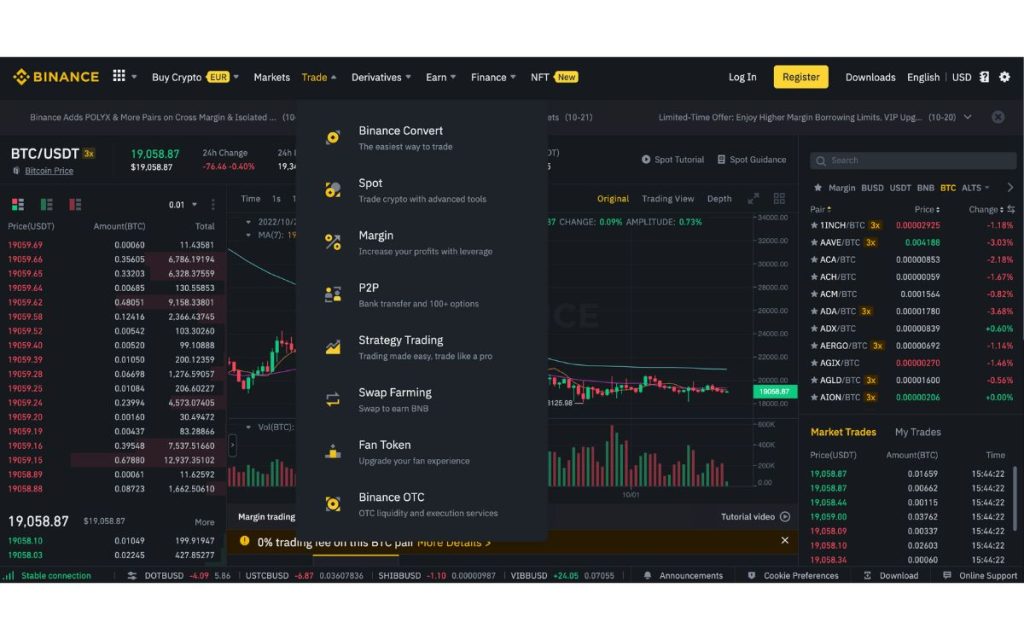

How to get started

1. Register for a Binance account and verify your identity.

2. Deposit the cryptocurrency you want to short into your Binance account.

3. Select the “Margin” tab from the main navigation bar.

4. Find the currency pair you want to short and select “Open Long” or “Open Short”.

5. Enter the amount of cryptocurrency you want to borrow and click “Submit”.

6. Set your stop-loss and take-profit orders and click “Submit”.

Once your position is closed, you will have either made a profit or lost money depending on the price movement of the currency pair.

What to watch out for

1. Check the liquidity of the market you’re planning to short. The last thing you want is to be stuck in a position because there’s no one to buy from you.

2. Make sure you have enough capital to cover the margin requirements and fees. Binance charges a 0.075% fee for each trade.

3. Consider using stop-limit orders to protect your position. A stop-limit order will automatically close your position at a certain price, limiting your losses.

4. Be aware of the risks involved in shorting. Cryptocurrencies are volatile and prices can move quickly, so you need to be prepared for the possibility of losing money.

5. Do your own research before shorting on Binance. There’s a lot of information out there, and it’s important to make sure you understand what you’re doing before putting your money at risk.

6. Be patient and don’t get too emotional about your trades. It’s important to remember that short-term fluctuations are normal in the cryptocurrency markets.

7. Have a plan for how you’ll exit your position. You don’t want to be stuck in a losing trade, so it’s important to have an exit strategy before entering a short position.

Summary

If you’re looking to short on Binance, you should keep a few things in mind. First, make sure you have enough money to cover the margin requirements. Second, research the coins you’re looking to short and understand the risks involved. Finally, remember that cryptocurrency is a volatile market, and prices can move quickly.

If you follow these tips, you’ll be well on your way to profiting from a short position on Binance. Good luck!