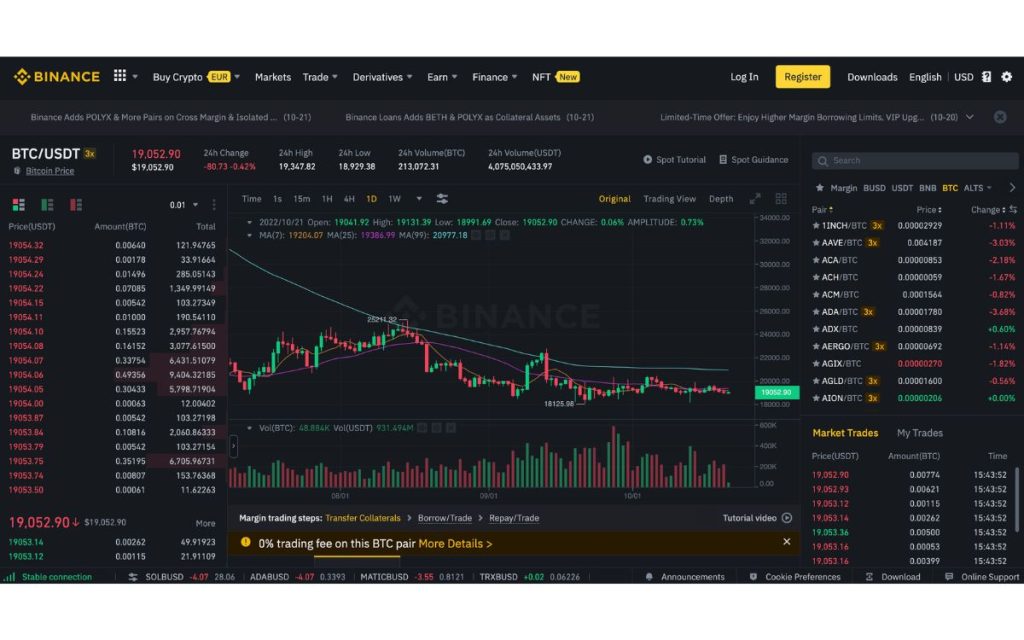

Binance Futures fees can be expensive to trade on. It is one of the most popular cryptocurrency exchanges. Here’s how you can reduce your fees and save money.

What is Binance Futures Fees?

Binance Futures Fees is a term used to describe the costs associated with trading on the Binance Futures exchange. These fees can be broadly divided into transaction fees and financing fees.

Transaction fees are charged every time you place an order on the Binance Futures exchange. The fee is calculated as a percentage of the total value of the order and is paid to the exchange when the order is executed.

Financing fees are charged when you hold a position overnight. The fee is calculated as a percentage of the value of your position and is paid to the exchange every 8 hours.

How can you reduce your fees with Binance Futures?

There are a few ways you can reduce the costs associated with trading on Binance Futures. Firstly, you can try to trade during periods of low volatility, when transaction fees are lower. Secondly, you can use limit orders rather than market orders, as this will reduce your transaction costs. Finally, you can hold your positions for longer periods of time to avoid paying frequent financing fees.

Another effective way is shorting. You may access this blog to learn more about how to short on Binance. You can also make use of crypto sign-up bonus offers to reduce costs.

The benefits of using Binance Futures

If you’re a trader who’s looking to take advantage of the many benefits of trading on Binance Futures, one of the things you’ll want to keep in mind is the fees associated with this platform. While the fees are generally quite reasonable, there are ways to reduce your costs even further.

Binance Futures is one of the most popular cryptocurrency futures exchanges with traders. The platform has very low fees and also offers a number of ways to reduce costs further. In this blog post, we will look at how you can use Binance Futures to trade cryptocurrencies with minimal fees.

Binance Futures offers some of the lowest fees in the industry. Trading on the platform is only 0.075% per side, and there is no commission charged on withdrawals. You can also get a 25% discount on trading fees by holding Binance Coin (BNB).

There are a few other ways to reduce costs when trading on Binance Futures. For example, if you are a maker, you will receive a 0.025% rebate. You can also choose to pay your trading fees in BNB, which will further reduce your costs.

Overall, Binance Futures is one of the most cost-effective ways to trade cryptocurrencies. The low fees and various discounts make it an attractive option for traders seeking to minimize costs.

What to consider when choosing a futures exchange

Fees are one of the most important considerations when choosing a futures exchange. Although most exchanges charge similar fees, there can be significant differences in how these fees are structured. For example, some exchanges charge a flat fee per trade, while others charge a percentage of the total value of the trade.

The fees charged by Binance Futures are very competitive when compared to other exchanges. For example, they charge a flat fee of 0.075% per trade. This means that if you were to trade $100 worth of Bitcoin, you would only be charged $0.075 in fees.

Summary

If you’re looking to trade on Binance Futures, it’s important to be aware of the fees involved. While the exchange is one of the most popular in the world, it can be expensive to trade on.

However, there are a few ways you can reduce your costs. First, try to trade during periods of low volume. Second, use limit orders rather than market orders. Finally, consider using a trading bot to help you automate your trades.

By following these tips, you can help keep your costs down and make more profitable trades.