Germany is known for its high-quality products and services, and that extends to its credit cards! Here are the best credit cards in Germany and why you should choose them.

Why credit cards are important

Credit cards are important for a number of reasons. They can help you build credit, which is important for your financial future. They can also help you manage your finances and make purchases more convenient.

There are a lot of different credit cards available on the market, so it’s important to compare your options and find the best one for your needs. Here are some things to consider when choosing a credit card:

Annual fee: Some credit cards come with an annual fee, so be sure to check whether this applies to the card you’re considering.

Interest rate: The interest rate on a credit card will affect how much you’ll pay in interest if you carry a balance on your card. Be sure to compare interest rates before you choose a card.

Rewards: Many credit cards offer rewards programs that allow you to earn points or cash back on your purchases. If you’re looking for a card that offers rewards, be sure to compare the different programs available and find the one that best suits your needs.

Foreign transaction fees: If you plan to use your credit card overseas, be sure to check whether the card charges foreign transaction fees. These fees can add up, so it’s important to be aware of them before you travel.

Choosing the best credit card for your needs can save you money and help you manage your finances more effectively. Be sure to compare your options and find the card that’s right for you.

Another option is crypto debit cards for those who are interested in investing in cryptocurrency.

The 5 best credit cards in Germany

There are many different credit cards available in Germany, so it can be hard to choose the right one. Here are the five best credit cards in Germany and why you should choose them:

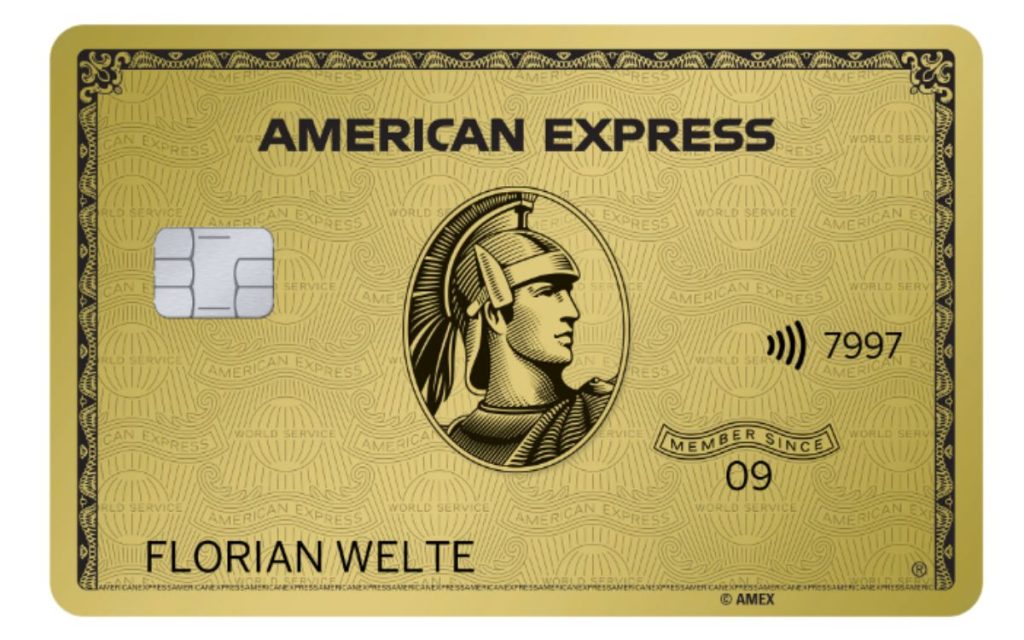

1. The American Express Gold Card

The American Express Gold Card is one of the best credit cards in Germany because it offers a great rewards program. You can earn points for every euro you spend, which can be redeemed for cash back, travel, or merchandise. There is no annual fee for this card, so it is a great option for people who want to earn rewards without paying an annual fee.

2. The Deutsche Bank Visa Card

The Deutsche Bank Visa Card is a great option for people who want a low-interest rate on their credit card. This card has an introductory APR of 0% for the first 12 months, which can save you a lot of money on interest if you carry a balance on your card. There is no annual fee for this card, so it is a great option for people who want to save on interest payments.

The Comdirect Mastercard is a great option for people who want a credit card with no foreign transaction fees. This card has no annual fee and no foreign transaction fees, so it is a great option for people who travel outside of Germany frequently. You can also earn cash back on your purchases with this card, which makes it a great choice for people who want to earn rewards on their credit card spending.

The DKB Visa Card is a great option for people who want a flexible rewards program. With this card, you can choose how you want to earn your rewards – either through cash back or through air miles. You can also redeem your rewards for travel, merchandise, or gift cards. This card has no annual fee and no foreign transaction fees, so it is a great choice for people who want to earn rewards on their spending without paying an annual fee.

5. The Barclaycard Visa Card

The Barclaycard Visa Card is a great option for people who want to earn rewards on their spending. With this card, you can earn points for every euro you spend, which can be redeemed for cash back, travel, or merchandise. There is no annual fee for this card, so it is a great choice for people who want to earn rewards without paying an annual fee.

What to look for when choosing a credit card

There are a lot of different credit cards out there, and it can be hard to know which one is the best for you. If you’re looking for the best credit cards in Germany, here are a few things to keep in mind.

First, consider what you’ll be using your credit card for. If you’re planning on using it for everyday purchases, look for a card with low interest rates and no annual fee. On the other hand, if you’re planning on using your credit card for larger purchases or travel, look for a card with rewards programs that will give you points or cash back on your spending.

Second, make sure to compare different credit cards before you decide which one to apply for. Look at things like interest rates, annual fees, and rewards programs to find the card that’s right for you

Finally, remember that the best credit card for you is the one that fits your spending habits and financial goals. There’s no one-size-fits-all answer when it comes to choosing a credit card, so take the time to find the right card for you.

How to use your credit card wisely

If you’re looking for the best credit cards in Germany, you’ve come to the right place. We’ll give you an overview of the different types of cards available and explain why you should choose them.

There are two main types of credit cards in Germany: Visa and Mastercard. Both have their own advantages and disadvantages, so it’s important to choose the right one for your needs.

Visa is the most widely accepted credit card in Germany, so it’s a good choice if you’re looking for general use. It’s also a good option if you’re planning on using your card for online shopping or overseas travel.

Mastercard is a good choice if you’re looking for a card with better rewards or cash back programs. It’s also a good option if you’re looking for a card with more flexible payment options.

No matter which type of card you choose, it’s important to use your credit card wisely. Here are some tips to help you get the most out of your card:

– always pay your bill on time to avoid late fees and interest charges

– only spend what you can afford to repay to avoid getting into debt

– try to pay off your balance in full each month to avoid paying interest

– beware of cash advance fees if you withdraw cash from an ATM

– be aware of foreign transaction fees if you use your card overseas

Summary

If you’re looking for a great credit card that will offer you top-notch service and great rewards, then you should definitely consider a German credit card. There are many different cards to choose from, so you’re sure to find one that fits your needs.

And because Germany is known for its high-quality products and services, you can be confident that you’re getting a great deal.