Freelancers that work internationally frequently encounter the challenge of working with many currencies. Many PayPal customers are surprised to learn that there are significant currency conversion fees associated with withdrawing funds in a currency other than their own when travelling abroad.

However, there is a solution that saved me hundreds of dollars in conversion fees. We’ll look at the ways in which eToro may help you save money when processing PayPal withdrawals in many currencies.

Currency Conversion Fees in PayPal explained

PayPal is one of the most popular online payment systems because of the ease and safety it provides its consumers. Currency translation costs can add up quickly when withdrawing payments from your PayPal account into another currency. PayPal’s foreign exchange fees are 5% of the transaction amount, are a significant drain on your finances. People that deal in foreign currency on a regular basis or have large amounts of foreign currency in their possession may find this cost to be quite onerous.

The solution to save the conversion fee eToro

eToro is a popular social trading and investment platform that has expanded beyond its initial focus on stocks and cryptocurrencies. One of eToro’s features that gets less attention is its ability to make international money transfers and currency changes inexpensive.

This is how it functions:

1. Create a free eToro account

First, you’ll need to create an eToro account, which is a simple and intuitive process. You can begin making deposits into your account immediately following its activation.

2. Fund Your Account

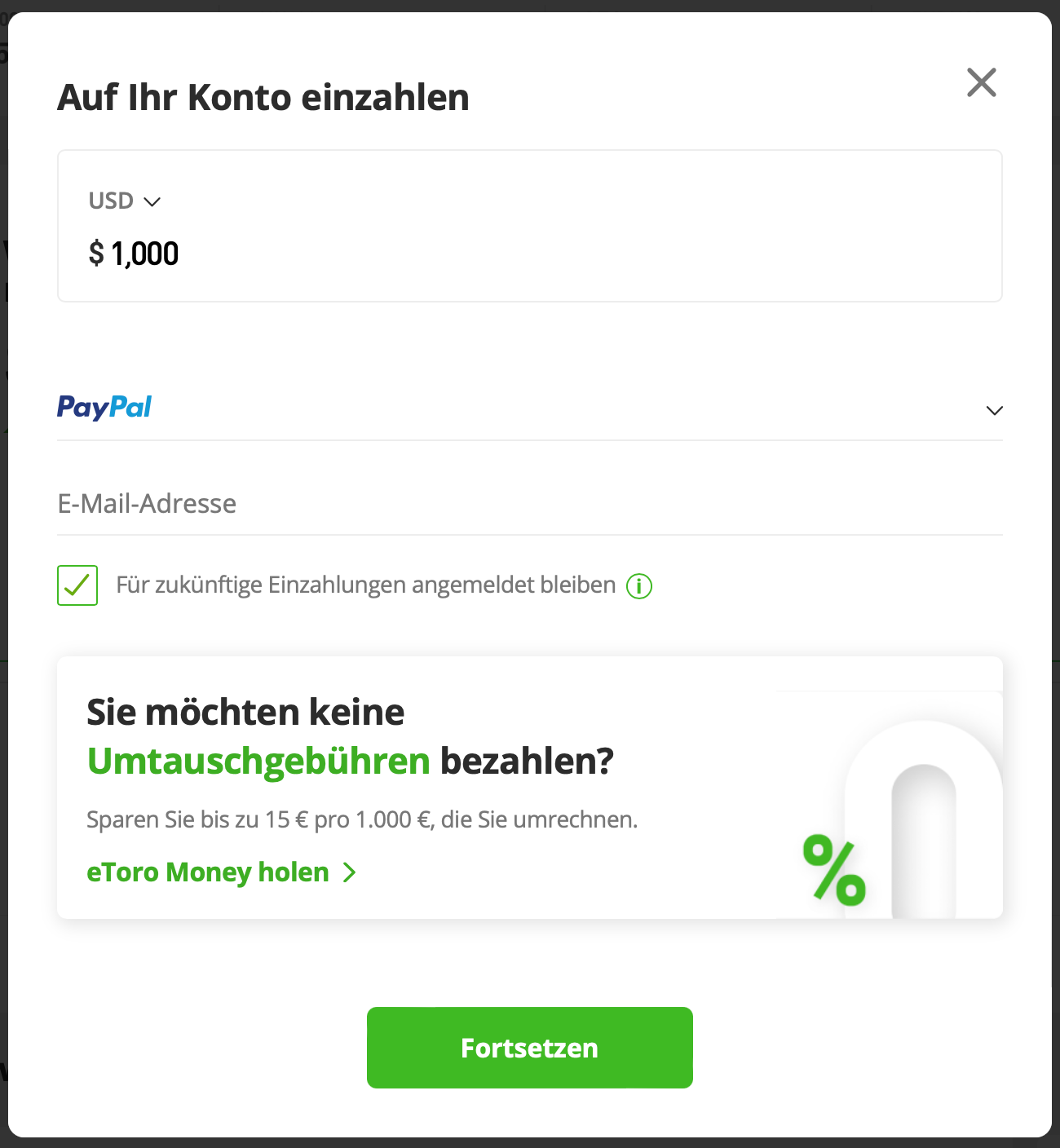

Unfortunately, PayPal wasn’t available for me for the first deposit. So first deposit a payment of $47 with your credit card (free of charge) and then deposit your foreign currency to eToro.

After that deposit your money from PayPal.

eToro supports the following currencies:

- EUR (Euro)

- GBP (British Pound Sterling)

- AUD (Australian Dollar)

- USD (United States Dollar)

3. Withdraw your money

Then you only have to withdraw your money. This takes a few days, but it saves you a lot of currency conversion fees. eToro only has a flat withdrawal fee of merely $5.

Compared to PayPal’s percentage-based foreign exchange costs, this can save you a significant amount, especially on bigger withdrawals.

Since eToro supports several currencies, you can withdraw your funds in the currency of your choice directly to your bank account, minimising currency conversion costs. You can save money on every transaction by avoiding PayPal’s currency conversion fees.

eToro vs. PayPal: Which Is Cheaper?

Let’s take a look at a real-world scenario to see how eToro may help you cut costs while making foreign exchange transactions:

Let’s say you wish to transfer $1,000 in foreign currency from an ATM to your personal bank account.

If you use PayPal, the exchange rate fee will cost you $50, for a total of $950.

When compared to PayPal, eToro’s flat withdrawal charge of $5 and minimal currency conversion expenses would allow you to keep nearly the entire $1,000.

The greater the sum, the more noticeable the difference. The savings may be significant and should be taken into account by those with larger amounts of foreign money.

So for only $1,000, you already save $45.

Conclusion

Because of its low fees and ease of use, eToro is the best option for handling PayPal withdrawals in multiple currencies. If you frequently deal in foreign currencies, you can save a lot of money by using eToro because of the platform’s support for multiple currencies and minimal withdrawal costs.

Whether you’re a regular flyer, a freelancer with clients throughout the world, or an online shopper who frequently makes purchases from international retailers, eToro can be a financial lifesaver. Therefore, if you frequently transact in foreign currencies through PayPal, you should think about the advantages of utilising eToro and putting your money to better use.