Vivid Money is a new money management app that claims to be the best on the market. We put it to the test, and here’s what we found in this Vivid Money review.

What is Vivid Money?

If you’re looking for a comprehensive money management app, Vivid Money is definitely worth checking out. It offers a wide range of features that can help you track your spending, budget for upcoming expenses, and even save money.

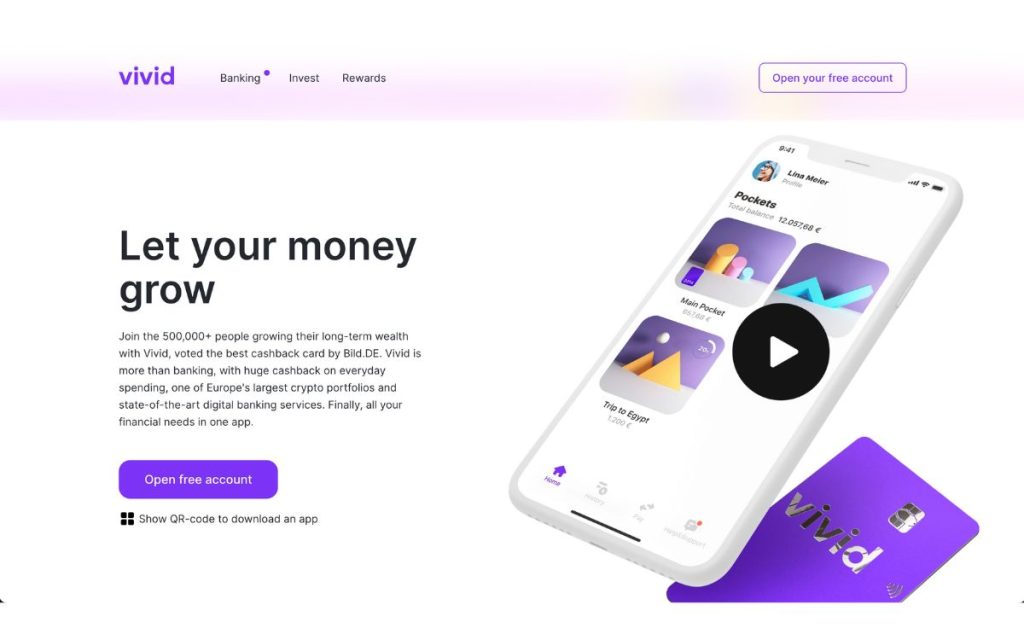

One of the best things about Vivid Money is that it’s very user-friendly. The interface is sleek and easy to navigate, and the app is packed with helpful features. For example, you can set up spending limits and track your progress over time. You can also add notes to each transaction, so you can remember what it was for later on.

Another great thing about Vivid Money is that it offers a wide range of integrations. This means that you can connect the app to your bank account, credit card, and other financial accounts. This makes it super easy to keep track of all your finances in one place.

Overall, Vivid Money is a great choice for anyone looking for a comprehensive money management app. It’s user-friendly, packed with features, and offers a wide range of integrations. If you’re looking for an app to help you manage your finances, Vivid Money is definitely worth checking out.

How does Vivid Money work?

Vivid Money is a money management app that allows users to see all of their financial information in one place. The app provides a clear overview of users’ spending, income, and debts. Users can also set up budgets and track their progress over time.

Vivid Money is free to download and use. However, users can upgrade to a premium subscription for $4.99 per month or $49.99 per year. Premium subscribers have access to additional features, such as credit score monitoring and custom budgeting tools.

So, what makes Vivid Money the best money management app? Here are some of the key features:

1. Clear Overview of Financial Information

Vivid Money provides users with a clear overview of their financial situation. Users can see how much money they have coming in, how much they’re spending, and what their debts are. This information is presented in an easy-to-understand format, so users can quickly see where they need to make changes.

2. Budgeting Tools

Vivid Money includes budgeting tools that allow users to track their spending and set limits on certain categories. This helps users stay on track with their financial goals and avoid overspending.

3. Credit Score Monitoring

Premium subscribers can monitor their credit score within the Vivid Money app. This feature is helpful for those who are working to improve their credit rating.

4. Customizable Interface

Vivid Money allows users to customize the interface to suit their needs. Users can choose which information they want to see on their dashboard and rearrange the order of the information. This makes it easy for users to find the information they need quickly and efficiently.

5. Safe and Secure

Vivid Money is a safe and secure way to manage your finances. The app uses 128-bit SSL encryption to protect your data. Additionally, all of your information is stored locally on your device, so you don’t have to worry about it being accessed by third parties.

What are the benefits of using Vivid Money?

Vivid Money is a money management app that allows users to see their spending, budget, and save money. The app also provides users with tips on how to save money. Some of the benefits of using Vivid Money include:

1. Access to your spending and budgeting information in one place

2. The ability to see where you are spending your money

3. Tips on how to save money

4. The ability to set up a savings goal and track your progress

5. A community of like-minded people who can offer support and advice

Are there any drawbacks to using Vivid Money?

One of the best things about Vivid Money is that it’s very user-friendly. The interface is clean and easy to navigate, and the app is packed with features that can help users manage their finances better. There are also some great budgeting tools available, which can be really helpful for those who are trying to save money.

However, there are some drawbacks to using Vivid Money. One is that the app primarily focuses on European users. This means that some features, such as currency conversion, may not be available for US users. Additionally, the app does not currently support joint accounts or multiple currencies.

Overall, Vivid Money is a great money management tool for individuals who want to take better control of their finances. While there are some drawbacks, such as the lack of support for US users and joint accounts, the app provides a lot of useful features that can help users manage their money more effectively.

Our verdict: is Vivid Money the best money management app?

If you’re looking for a great money management app, Vivid Money is definitely worth checking out. It’s easy to use, helps you stay on top of your finances, and even offers some cool features like cash-back rewards.

Our verdict? Vivid Money is definitely one of the best money management apps out there. If you think Vivid Money is not for you, you can always try out other banks, such as bunq and Tomorrow Bank.