N26 is a popular new bank with great features, but is it the right bank for you? Read our N26 review to learn more about the platform and whether it’s the right choice.

What is N26?

N26 is a digital bank that offers customers a convenient way to manage their finances. The company is headquartered in Berlin, Germany, and was founded in 2013. N26 has over 2 million customers in 25 European countries.

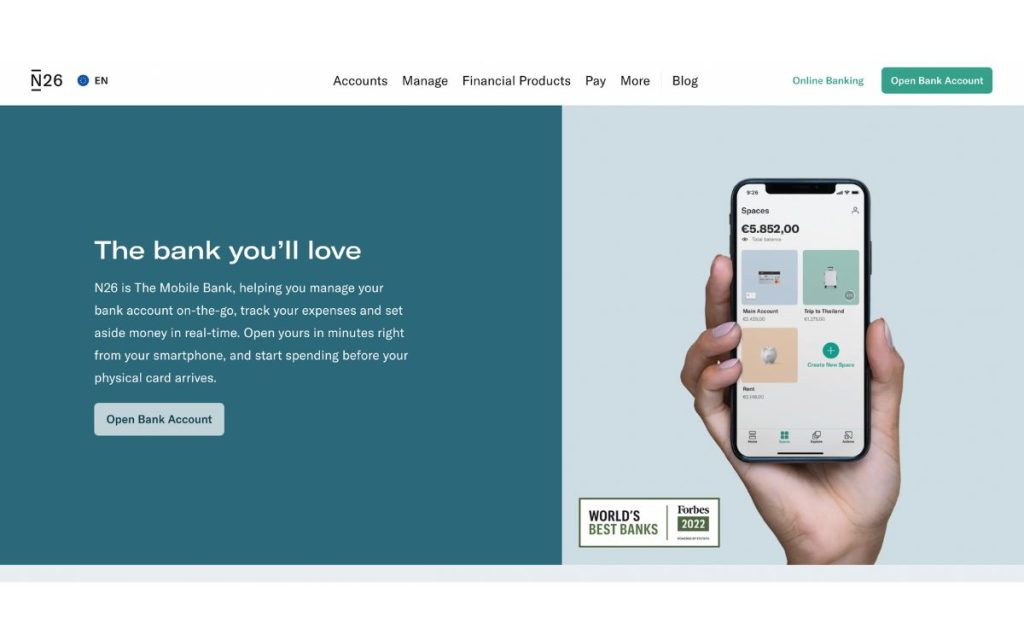

N26 offers its customers a Mastercard, which can be used for withdrawals and payments worldwide. Customers can also set up direct debits and standing orders and make transfers to other N26 customer accounts. In addition, N26 provides a mobile app that allows customers to track their spending, set up budgets, and receive real-time notifications of their account activity.

N26 is a great option for people who are looking for a digital bank that offers a wide range of features and services. The company is constantly expanding its reach and adding new features, so it is worth signing up for an account if you are looking for a convenient way to manage your finances.

Why you should care about N26

N26 is a mobile banking app quickly gaining popularity due to its ease of use and attractive features. Though it is still a new entrant in the market, it has already managed to make a name for itself. In this article, we will take a closer look at N26 and what it has to offer.

N26 is a German neobank that was founded in 2013. The company started off as Number26 but rebranded to N26 in July 2016. It currently operates in 24 European countries and has over 1 million customers.

N26 offers a free basic bank account with no monthly fees. This account comes with a Mastercard debit card which can be used for ATM withdrawals, online shopping, and contactless payments. For those who want more features, N26 also offers premium accounts with additional perks such as insurance and higher withdrawal limits.

One of the main selling points of N26 is its ease of use. The app is very user-friendly and makes it easy to transfer money, check your balance, and see your transaction history. You can also set up notifications so that you are always aware of your account activity.

Another great feature of N26 is that it offers instant notifications whenever there is a transaction on your account. This way, you can keep track of your spending and make sure that everything is in order. N26 also has a built-in budgeting tool that can help you stay on top of your finances.

If you are looking for a mobile banking app that is easy to use and has all the features you need, then N26 is worth considering. With its competitive pricing and great features, N26 is quickly becoming one of the market’s most popular mobile banking apps.

The benefits of signing up for N26

If you’re looking for a bank offering great customer service, convenience, and security, you’ll want to check out N26. This online bank has quickly become a favorite among consumers for its ease of use and excellent features.

One of the best things about N26 is that it offers free checking and savings accounts with no minimum balance requirements. This makes it a great option for people who are just starting out with their finances or don’t have much money to deposit.

Another great feature of N26 is its mobile app. This allows you to access your account anywhere, making it very convenient. You can also use the app to deposit checks, transfer money, and pay bills.

Lastly, N26 is a very safe and secure bank. It uses state-of-the-art security measures to protect your information and keep your money safe. You can rest assured that your money is in good hands with N26.

The drawbacks of N26

N26 is a digital bank with a mission to make money simple, fast, and modern. However, there are some drawbacks to using N26 that customers should be aware of before signing up.

One of the biggest complaints about N26 is that customer service can be very slow in responding to questions and concerns. This can be frustrating for customers who need help with their accounts or are having problems.

Another issue is that N26 does not have a physical presence in every country. This can make accessing your account difficult or getting help if you’re traveling internationally.

Lastly, some customers have reported being charged hidden fees by N26. Read the fine print carefully before signing up for an account to avoid unexpected charges.

Despite these drawbacks, N26 still offers many benefits for its customers. If you’re looking for a digital bank with modern features and great customer service, N26 may be worth considering.

Should you sign up for N26?

If you’re considering signing up for N26, you’re probably wondering if it’s worth it. This blog post will look at what N26 offers and help you decide if it’s right for you.

N26 is a bank that offers a variety of features and benefits, including no fees on international transactions, a handy mobile app, and the option to set up a savings account with high-interest rates.

However, some drawbacks exist, such as lacking physical branches and limited customer support options.

Overall, N26 is a good option for those looking for an online bank with plenty of features. However, it’s important to weigh both the pros and cons before deciding.

Summary

N26 is a great new bank with some great features, but it’s not right for everyone. Make sure you learn more about it before signing up to make sure it’s the right bank.