It’s no secret that money management can be tough, but it doesn’t have to be. With joint accounts in Revolut, you and your partner can take control of your finances and save money like never before. Here are 5 great reasons to get started.

Why you should get a joint account in Revolut

If you’re looking for a way to manage your finances with your partner, then you should definitely consider getting a joint account in Revolut. Here are just some of the reasons why:

1. You’ll be able to see all of your transactions in one place.

2. You can easily split bills and expenses between the two of you.

3. You can set up spending limits and track your progress towards financial goals.

4. You’ll get access to exclusive features and discounts when you use your Revolut joint account.

So what are you waiting for? Get a joint account in Revolut today!

What is Revolut?

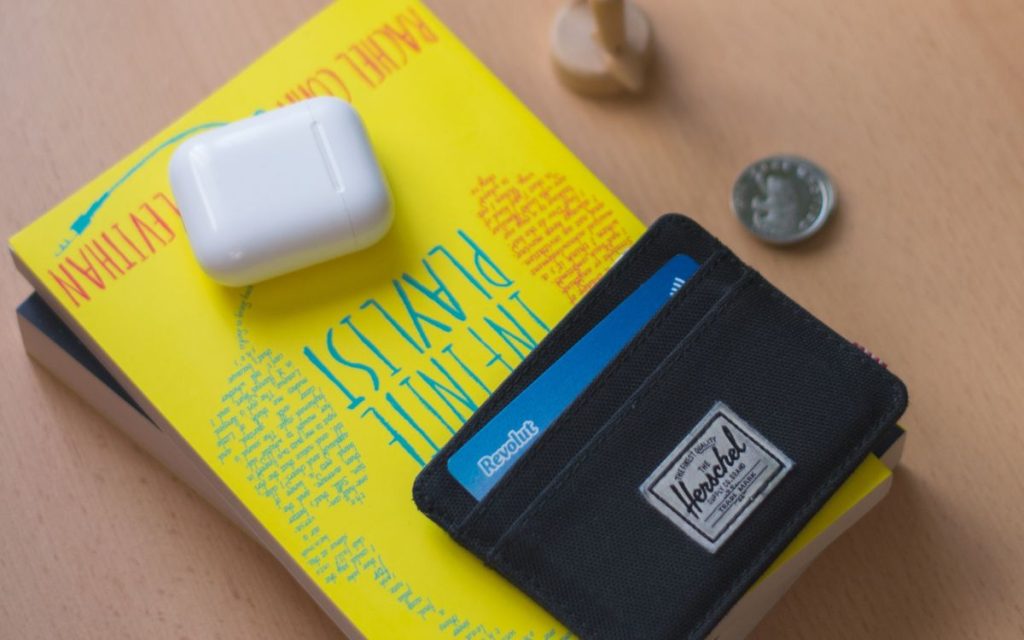

If you haven’t heard of Revolut yet, you’re missing out. Revolut is a financial technology company that offers users a prepaid debit card, currency exchange, and peer-to-peer payments. Revolut also has a joint account feature that lets users share money with friends and family members.

There are plenty of reasons to get a joint account with Revolut. For one, it can help you manage your finances more efficiently. With a joint account, you can track your spending and see where your money is going. This can be helpful if you’re trying to save money or stick to a budget.

Another reason to get a joint account with Revolut is that it can help you build credit. If you’re looking to buy a house or take out a loan, having a good credit score is essential. A joint account can help you build credit by showing that you’re responsible with money.

Finally, a joint account with Revolut can simply make life easier. If you’re always splitting bills with friends or family members, having a joint account can make things a lot simpler. You won’t have to keep track of who owes what – everything will be in one place

So if you’re looking for a financial partner that can help you manage your money more effectively, Revolut is the perfect choice. Sign up today and get started on building your financial future!

5 great features of Revolut that will save you money

If you’re looking to save money, a joint account in Revolut is a great way to do it. Here are 5 great features that will help you save money:

1. Streamlined expenses – Having a joint account in Revolut allows you to see all of your shared expenses in one place. This makes it easy to track where your money is going and identify areas where you can cut back.

2. Save on fees – Joint accounts in Revolut come with no monthly fees, so you can save on bank charges every month.

3. Earn interest – All accounts in Revolut earn interest, so you can grow your savings even faster.

4. Get cashback – With certain joint accounts in Revolut, you can get up to 5% cashback on your everyday spending.

5. Free ATM withdrawals – All joint accounts in Revolut come with free ATM withdrawals, so you can access your cash without any fees.

How to get started with Revolut

If you’re looking for a way to manage your money with your partner more effectively, then you should definitely consider getting joint accounts in Revolut. Here’s why:

1. You’ll be able to see all of your transactions in one place.

With Revolut, all of your transactions will be displayed in one handy place, so you can keep track of your spending more easily. This is particularly helpful if you’re trying to stick to a budget.

2. You can each set up individual budgets.

Another great feature of Revolut joint accounts is that you can each set up your own individual budgets. This means that you can keep track of your own spending without having to worry about what your partner is doing.

3. You can easily transfer money between accounts.

If you need to transfer money between your Revolut joint accounts, it’s super easy to do so. You can do it all from the app, so you don’t even need to login to your online banking.

4. You’ll earn rewards for every purchase you make.

With Revolut, you’ll earn rewards for every purchase you make with your joint account. These rewards can be used to get cashback or discounts on future purchases, so it’s a great way to save money.

5. You can manage your account from anywhere in the world.

Revolut joint accounts can be managed from anywhere in the world, so if you’re travelling together, you can still keep on top of your finances. All you need is an internet connection and the app on your phone.

To deeply discover the efficiency of Revolut, check out other mobile banks that give the same offers, such as bunq, N26, Vivid Money, and Tomorrow Bank.

Since a few days Revolut published their ultra plan.

Summary

If you’re looking for a financial partner to help you manage your money and access great features like currency exchange and peer-to-peer payments, then you should definitely sign up for Revolut.

With a joint account, you and your partner can both take advantage of all that Revolut has to offer, and you’ll be able to keep track of your finances more easily. So don’t wait any longer, sign up for Revolut today!